Decentralized Finance (DeFi) has revolutionized the traditional financial landscape by offering innovative solutions for lending, borrowing, trading, and earning yield on digital assets. Among the various DeFi protocols, Yield Farming and Liquidity Mining have gained significant traction, enabling users to earn passive income by providing liquidity to decentralized exchanges and liquidity pools. In this expert analysis, we delve into the intricacies of Yield Farming and Liquidity Mining, exploring their mechanics, benefits, and risks for participants.

Understanding Yield Farming

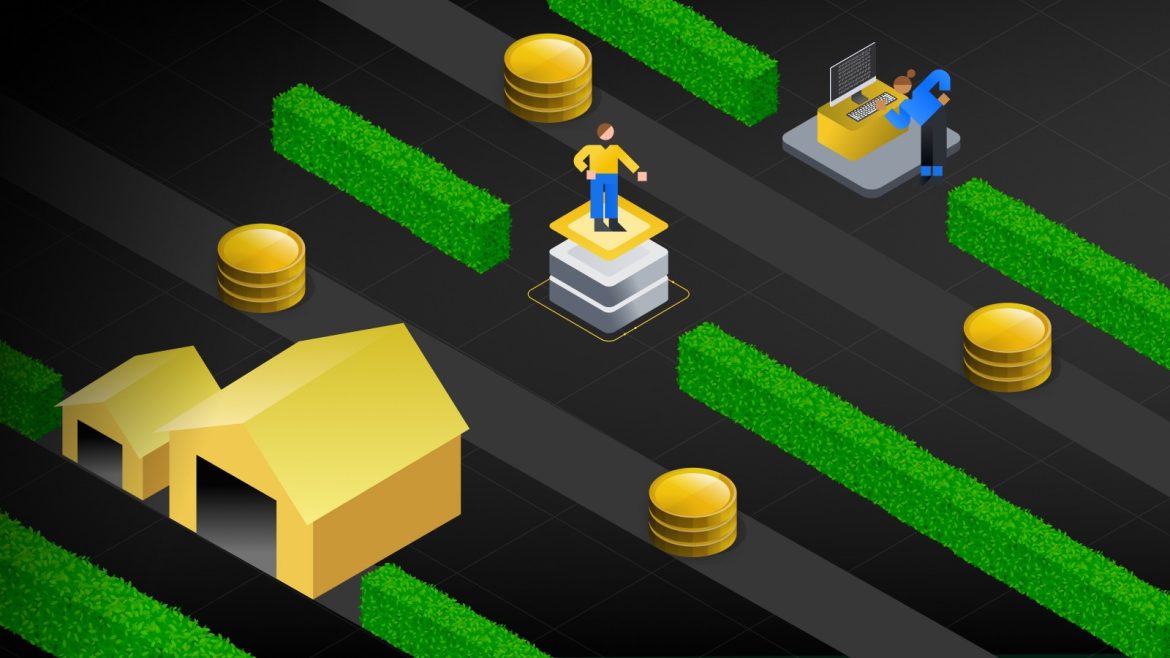

Yield Farming, also known as liquidity mining, is a strategy employed by DeFi platforms to incentivize users to provide liquidity to their liquidity pools. Liquidity providers deposit their assets into these pools, which are utilized for decentralized trading and lending protocols. In return for their participation, liquidity providers receive rewards in the form of additional tokens, typically native governance tokens or protocol-specific tokens, distributed proportionally to their share of the liquidity pool.

One of the key mechanisms driving Yield Farming is the distribution of yield through liquidity mining incentives. These incentives are funded by the protocol’s treasury, which allocates a portion of its native tokens for distribution among liquidity providers. The distribution of rewards is often determined by factors such as the amount of liquidity provided, the duration of participation, and specific rules defined by the protocol’s smart contracts.

Benefits and Opportunities

Yield Farming offers several benefits and opportunities for participants seeking to maximize their returns on digital assets. Firstly, it enables users to earn passive income by deploying their idle assets into liquidity pools, generating yield through trading fees and liquidity incentives. Additionally, Yield Farming provides liquidity to decentralized exchanges, enhancing market efficiency and reducing slippage for traders executing transactions on these platforms.

Moreover, participating in Yield Farming allows users to gain exposure to a diverse range of DeFi projects and protocols, thereby diversifying their investment portfolios and potentially capturing upside from emerging trends and innovations in the DeFi space. Furthermore, Yield Farming incentivizes early adopters and liquidity providers, fostering community engagement and network effects within decentralized ecosystems.

Risks and Considerations

While Yield Farming presents lucrative opportunities for earning passive income, it also entails certain risks and considerations that participants should be aware of. One of the primary risks associated with Yield Farming is impermanent loss, which occurs when the value of deposited assets fluctuates relative to the value of the assets in the liquidity pool. Impermanent loss can erode the overall value of liquidity provider positions, especially in volatile market conditions.

Additionally, participants should carefully evaluate the security, transparency, and governance mechanisms of the DeFi protocols in which they choose to engage in Yield Farming. Due diligence is essential to assess the credibility and reliability of the underlying smart contracts, as well as the risk of potential exploits or vulnerabilities. Furthermore, participants should consider the long-term sustainability and viability of Yield Farming strategies, as market dynamics and protocol incentives may change over time.

Conclusion

In conclusion, Yield Farming and Liquidity Mining have emerged as prominent features of the DeFi ecosystem, offering attractive opportunities for users to earn passive income and participate in decentralized finance protocols. By providing liquidity to liquidity pools, participants can contribute to the liquidity and efficiency of decentralized exchanges while earning rewards in the form of additional tokens. However, it is essential for participants to carefully assess the benefits, risks, and considerations associated with Yield Farming, conduct thorough due diligence, and diversify their strategies to mitigate potential risks and optimize returns in the dynamic landscape of decentralized finance.